What's Next for Google?

An In-Depth Exploration of 9 Threats and 9 Possibilities

The death of Google at the hands of ChatGPT may be a popular narrative, but the truth is far more nuanced. The destabilization of the Google’s Search empire has been brewing for years, and the emergence of language models represents just the latest development in a complex web of trends. In this post, we’ll first uncover the 9 forces putting pressure on Google’s Search reign, then speculate on the 9 strategic moves Google could make to navigate these turbulent waters.

My frustration with the search quality started somewhere between 2017 and 2018. The returned links were not strictly following the queries anymore. Instead, they would be a couple of steps broader in scope. Initially, I thought it was probably some recent algorithm experimental updates that weren't working out as intended; Google would eventually correct the problem. But things kept getting worse every year.

It was refreshing to see the now-famous article by Dmitri “Google Search Is Dying” and the intense level of engagement around it. I was far from being the only one.

It’s also worth reading the full twitter thread from Michael Seibel:

In short, why did Google Search results become so bad for some users?

SEO Exploitation

In the never-ending game of cat and mouse, SEO marketers are constantly trying to crack the code and rise to the top of the page, while Google continuously updates its algorithm to keep low-quality content at bay. By now, it appears the SEO gang has won.

The SEO aspect has two sides. On one side, you have the legitimate goal of boosting quality content or products to gain visibility and attract potential customers. But on the flip side, there's the overwhelming spread of spam, where the only intention is to generate income through AdSense placements by tricking Google into thinking it's relevant content. Sadly, Google has a vested interest in this problem as it profits from ads displayed on these fraudulent pages.

This situation leads to a weird place where the outcome is bad for the user experience but pretty good for Google's business. When incentives are not aligned, things go downhill.

Ads Escalation

The pressure of constant growth requirements led the company to keep increasing the number of sponsored links. As a result, it now reached a point where, for some keywords, the first page looks like an overstuffed sandwich made of ads with only a few crumbs of organic content.

Unsolicited “Smart Search”

This is well put by Dmitri Brereton from the same post:

Google increasingly does not give you the results for what you typed in. It tries to be “smart” and figure out what you “really meant”, in addition to personalizing things for you. If you really meant exactly what you typed, then all bets are off.

Even the exact match query operator (“ ”) doesn’t give exact matches anymore, which is quite bizarre.

For the query operator (" ") issue, Google later responded, arguing this is incorrect and the operator still serves its purpose.

My annoying experience with (" ") usage is not that it changes the query, but it's that it often leads to the surprising: “Your search did not match any documents”, like in this example:

While it might be true, I'm having a hard time believing that the entire Internet doesn't have even a single page with that exact sequence.

The other forces squeezing Google Search

So far, we looked at:

1. Search quality degradation

Force #1, that may impact Google's dominance in the future.

There are, however, 8 other dynamics at play. Some are already taking place, and others are likely to emerge in the future:

2. Amazon Search

More and more people are bypassing Google and taking the express lane straight to Amazon to search for product information. It is estimated that 61% of product searches now start on Amazon. This shift in behavior is due to a couple of reasons. First, the issue discussed earlier of the declining reliability of Google's results. Second, the efficiency and convenience of Amazon's one-stop shop for comparing prices, reading reviews, and making purchases.

Interestingly, Amazon started its sponsored search ad business about ten years ago. It reached an annual revenue of $38 billion and grew by 19% from the previous year. In comparison, Google Search's revenue in Q4 2022 dropped 2% from the prior year.

3. Instagram and TikTok Search

For the younger generation, seeking out the ultimate eatery isn't a matter of checking Google Maps. Instead, they turn to TikTok and Instagram to discover visually appealing dishes. Likewise, they don't bother with a Google Search when it comes to finding a cosmetics product review. Instead, they watch videos of the product in action from people they can relate to directly on their favorite social media apps.

TikTok and Instagram typically work best for leisure-related content, as users seek authentic observations from people just like themselves rather than sterile search engine-optimized results. However, these platforms also have the challenge of influencer-manipulated popularity, but that's a topic for another day.

For now, Instagram and TikTok are eating into Google’s core products as covered by TechCrunch. It’s worth reading the entire piece.

4. Reddit

This is best summarized with this extract from Dmitri’s original post:

Reddit is currently the most popular search engine. The only people who don’t know that are the team at Reddit, who can’t be bothered to build a decent search interface. So instead, we resort to using Google, and appending the word “reddit” to the end of our queries.

And

Why are people searching Reddit specifically? The short answer is that Google search results are clearly dying. The long answer is that most of the web has become too inauthentic to trust.

5. Microsoft Bing

I'd give Bing a shot in the past only when Google's answers left me feeling irritated. Yet, over the years, it began to bear a striking resemblance to the search giant in both appearance and functionality.

The problem with Bing was not that it was a bad product but that it was very undifferentiated. What was the point of using it?

Even after nearly a decade and a half, their global market share is only at about 3.5%.

But

The dynamics changed in 2022 with the unexpected massive traction of ChatGPT, and the announcement of a $10 billion investment by Microsoft in OpenAI. The speculation that Microsoft would integrate the technology into Bing became rampant and finally materialized, perhaps sooner than people expected. It was officially launched at an an event on February 7th.

The hybrid search and chat approach combined with the seamless integration with the Edge browser creates a seemingly compelling experience. Here's a review in less than 10min.

As a response, Google rushed to schedule its similar event the day after, showcasing their chatbot Brad, I mean Bard. The demo was somewhat underwhelming, and the episode was tarnished when the results returned an incorrect answer.

The reactions were quick to follow:

To be fair, disseminating false information by language model-based bots is not a unique problem to Google. But if such a large corporation is set to embark on a high-stakes announcement, it's baffling that no one bothered to do a basic fact check. Maybe by running a Google search?

The funny thing is that even the Microsoft demo was riddled with inaccuracies, but no one noticed until a recent post, “Bing AI can’t Be Trusted” exposed all the glitches. So, it turns out the Microsoft team is also guilty of neglecting to run manual checks on their fancy demo.

But regardless of the drawbacks inherent to LLMs, it appears that Bing is set on a new differentiated and experimental trajectory that makes it at least more interesting than Google for the time being.

The question is how far will Google go to implement a similar setup?

Microsoft's advantage does not lie in technology since Google can develop something comparable, and both companies will face the same LLMs drawbacks. The main edge is that the potential business risk for Microsoft is much lower. They won't shed a tear even if they lose half of the ad revenue.

In 2021, Google ad revenue (including YouTube) represented about 80% of the total. For Microsoft, Bing amounted to only 5%. Being the underdog gives Microsoft a safer playground to experiment more aggressively with self-disruption.

For now, the stock market is mirroring that perception. Google's stock price took a hit after the Bard error, but Microsoft is still unaffected even after the Bing Chat meltdowns keep getting more hilarious.

6. Apple

It's not a secret anymore that Google pays Apple a hefty amount to keep its search engine as the default in Safari. The amount is not officially disclosed, but analysts estimated the payment to be $15 billion in 2021 and to reach $18 to $20 billion in 2022. Google Search ad revenue was $162 billion that year, not including YouTube and AdSense.

Let's envision a hypothetical low-case scenario where the current deal between Google and Apple is modeled around a 'virtual revenue share' with a 55/45 split. In this case, the $18 billion allegedly paid to Apple would translate to approximately $40 billion worth of search ad revenue for Google, roughly 25% of their total search ad revenue [1]. That's a substantial chunk of the market, and it's all controlled by one company with the power to shut it down at a moment's notice [2].

Now, why would Apple terminate that deal? It's lucrative even for a company at the scale of Apple.

There are a couple of reasons why it could happen. First, Apple is marketing itself as a privacy-centric company. Sending search traffic to Google doesn't fit well with the privacy narrative. Second, Apple actually has its own search engine, Spotlight. It is mainly known for local device search, but it has discretely evolved since iOS 15 by showing more and more external web results with direct links and images, bypassing Google. The interesting thing about Spotlight is that it's a browser-less experience tightly integrated with the operating system.

Apple also has Siri, which has significantly improved speech recognition and synthesis but is still totally useless for natural language processing. However, it is inevitable for Apple to build its GPT-like language model at some point, empowering Siri to finally fulfill its original role as a smart virtual assistant. When that happens, the marriage of Siri and Spotlight will be like a power couple, offering a similar or better experience than what's currently available but entirely outside the browser.

Moreover, Apple has been expanding its services portfolio with offerings such as TV+, Fitness+, Music, Arcade, and iCloud. The company's next logical step could be introducing an LLM-based premium Siri+ with a monthly subscription. Given the billion+ installed base of iOS devices, Apple should have no trouble compensating for and surpassing any lost revenue from the termination of its deal with Google.

7. Other search engines

DuckDuckGo, the privacy-focused search engine, got trendy at some point but is still at only ~0.6% global market share.

Newcomers such as Neeva, co-founded by a Google veteran, are more interesting, though. Neeva is not only more private but is ad-free. In addition, they offer subscription plans with unlimited search and additional privacy with a bundled VPN. Neeva has also introduced NeevaAI, a hybrid search and language model engine, addressing the two common criticisms of ChatGPT - the lack of sources and blindness to post-2021 information-.

The advantage of their business model lies in their perfectly aligned incentives. Neeva gets paid by the users they actually serve instead of third-party advertisers.

Perplexity.ai, another newcomer with a similar approach, is also worth keeping an eye on.

8. ChatGPT and other language models

By now, it is clear that ChatGPT has taken the throne as the superior way to address certain queries, despite its known imperfections. One of the critical aspects OpenAI got right was the early positioning. ChatGPT was introduced as an experimental research release, which made users much more tolerant of its faults.

It only takes a handful of experiences for anyone to be hit with the strong sentiment that:

There's simply no going back.

It's such a relief to see the unpolluted direct responses to your queries nicely structured. Also, the ability to ask follow-up questions sets the chatbot apart from conventional search engines.

The sentiment has been widely echoed in the tech scene.

The reported 100 million users two months after the launch is an unprecedented uptake and a confirmation that the interest is far beyond the typical early adopters and tech enthusiasts.

What remains to be seen is:

The timeline for the manifestation of the impact on Google's ad revenue and the magnitude of that impact.

The search queries are broadly of two kinds. First, the questions that seek direct answers or solutions to specific problems. Second, the requests that intend to look for the source websites for further navigation. The latter type is relatively immune for now. The Google revenue risk will be determined by the ratio between these two types of queries. That number is not publicly disclosed, but Google does for sure have the data. Given their recent panic reaction, we could speculate that the first kind of request represents a significant portion.

Besides, ChatGPT and other chat-based language models represent just the first wave that still relies on centrally run engines.

There's an inevitable second wave that will arise at some point where language models can run locally on devices. This evolution will mirror the trajectory of AI image generation. At first, server-side processing was necessary, as seen with services like DALL-E. But the release of Stable Diffusion brought a more compact model with comparable abilities that could run on a consumer-grade GPU. For instance, the Stable Diffusion optimized version for Apple silicon can work on an iPad, producing a photo in about 40 seconds.

For now, language models are still highly demanding in computing resources. Still, the curves of the increasing power of consumer chips and declining model sizes will likely intersect in a few years. At that point, Google's search competitors will no longer be restricted to Microsoft and a handful of major corporations. Instead, every consumer device could run its own pre-trained ChatGPT-like version and bypass Google search.

9. The Justice Department

A few weeks ago, the Justice Department dropped the hammer on Google, suing the tech giant for monopolizing digital advertising technologies.

Google is accused of violating antitrust laws and stifling competition through its dominance in the 'ad tech stack.' The legal action is like a storm cloud hanging over the company, casting uncertainty and doubt.

It's unclear if this lawsuit has any real shot at taking down Google ad empire, but it's a burden they could certainly do without at this moment.

What should Google do?

Let's now strap on our optimistic caps and dive into some speculative reflections on the moves Google could make to break free from this tangled web.

Despite the challenges, I am optimistic about Google's future. The company has a talented workforce, a massive cloud computing infrastructure, a mastery of the latest AI technologies, owns DeepMind, and let's not forget:

They had the research team that invented the ‘T’ in GPT.

First, let's address the elephant in the room. This is what many are quietly thinking, but few are loudly talking about.

1. CEO change

Seven years is a respectable tenure, and I do not mean to undermine Sundar's achievements in any way. However, the present circumstances are shifting the landscape in an unprecedented manner, and it seems like a good time to consider a leadership transition.

If Steve Balmer was still running Microsoft, it is unlikely that the company would be where it is today.

Om Malik lately wrote Does Google need a new CEO?:

Google’s board, including the founders, must ask: is Pichai the right guy to run the company, or is it time for Sundar to go? Does the company need a more offense minded CEO? Someone who is not satisfied with status quo, and willing to break some eggs?

2. Double down on the Search API

Google already has a search API called Programable Search Engine. It allows developers to initiate Google search requests and integrate the results into their apps and websites.

Although it's unknown how much revenue this service generates, it could become more valuable than ever with the rising popularity of LLMs, which will still require real-time internet search to be fully viable. As a result, there may be an opportunity to significantly increase the price of this service if the demand meaningfully increases.

3. Get serious about YouTube Premium

YouTube is a goldmine of content. Sadly, it is hindered by its current recommendation engine. The algorithm is tailored to maximize attention by serving videos likely to attract views and serve ads. The approach works well financially for free users, with YouTube ads revenue reaching $29 billion.

There's, however, an untapped segment of customers that:

Don’t like to see ads

Ready to pay more if they could control what they see

On the positive side, Google's already launched YouTube Premium. I gave it a shot, and it's a fantastic relief not to be bombarded with advertisements. Unfortunately, it failed to meet the second requirement - the algorithm remained identical to the free version. As a result, I was still inundated with irrelevant videos of little interest.

The opportunity here lies in building a separate recommendation engine for Premium users. For example, the alternative algorithm could incorporate a natural language prompt to provide a customizable recommendation page that genuinely resonates with users' video preferences.

Another interesting feature would be the option to generate custom playlists with a prompt. For example:

create a playlist with the best educational videos about <topic> that are no longer than <x> min.

If Google greatly improves its YouTube Premium value proposition, it might see significant growth in paid subscribers.

4. Launch Bard Premium (B2C)

So far, both Microsoft and Google have opted for integrating their AI chat features within the existing search engines for free and rely on existing ad revenue.

Similarly to YouTube, there might be space for a paid version of Bard that won't be polluted with ads. But to captivate users, the offering must be beefed beyond mere ad elimination.

ChatGPT is currently running the experiment with the plus version at $20 a month. However, the feature set is basic for the time being. It only offers faster priority access during congestion and a sneak peek at upcoming functionalities.

Perhaps, the approach shouldn't be about adding chat to search but rather about adding search to chat.

In essence, it would be wise for Google to consider launching a standalone bard.com in Beta and refraining from altering the classic search on google.com. Depending on the prompt, the new experience could abstract the search aspect by having the engine decide whether to use the LLM or the classic search. When a traditional search is required, the LLM can still be utilized for structural organization and summarization before presenting the results to the user. This kind of flow would offer a refined and consistent user experience and be more differentiated from Microsoft and ChatGPT.

This shift would change the mission from:

Old Google

Organizing the world’s information - For free against ads

To:

New Google

Distilling the world’s information - For money with no ads

5. Explore BB: Bard for Business

The opportunity to create tailor-made language models for various industries, such as legal, healthcare, education, customer service, retail, media, gaming, government, and management consulting, is ripe for the taking.

The current LLMs may not be ready for prime-time deployment in professional environments as they were trained on publicly available Internet data. Nevertheless, it is highly encouraging to see that they have achieved their current performance level without using private, professional data, which indicates their enormous potential.

There are three key advantages of a potential B2B offering. First, it opens up the possibility for Google to set a value-based Enterprise price level. Second, the risk of hallucination can be better contained when the output isn't meant for the end user. The respective domain experts can vet the results and take accountability before deliverables go to the end customers. And last but not least, the models should, in theory, hallucinate much less as they would have been trained on quality domain-specific data.

6. Acquire Reddit

Conde Nast currently owns Reddit, and there's no hint of it being up for sale. Yet, while Google is still swimming in a sea of cash, this could be a good time for them to make an irresistible offer.

If Google were to acquire Reddit, it would own a more authentic version of the Internet - one untouched by the poison of SEO. In turn, Reddit would gain from a tech company's expertise to rejuvenate its user interface and internal search capabilities. But should Google succumb to the evil temptation of aggressively monetizing Reddit through more ads, it would ruin everything. Instead, the objective should be to achieve Reddit's growth with a non-ad-based revenue model.

Would I be happy as a user to see that happening? Definitely not. But if I put on the Google hat, it might be a move worth considering.

7. Go all-in with Google Workspace

I always thought that the former “Google Apps” that became “G Suite” and now “Google Workspace” was a niche alternative mostly used by startups and some SMEs. So I was stunned to discover that they surpassed Microsoft Office 365 in market share, according to statista.com.

Assuming the data source is credible, it's an achievement deserving a standing ovation, especially since the product suite was launched in 2006. it's like a young challenger stepping into the ring against the decades-long dominance of Microsoft Office and beating it.

“Bard for Business”, covered in point #5, and this are like a match made in heaven.

Imagine a future where Google's app suite is infused with AI capabilities beyond the basic generation of email replies and text completion. If Google can invest in research around specialized language models, they can take Google Docs, Sheets, and Slides to new heights by creating industry-specific versions powered by foundation models trained on the unique data of each respective field. This approach would open up the possibility of further customizing these tools by offering add-on services that allow customers to fine-tune the models using their own private enterprise data. The result would be a set of truly unique tools for each business, serving as a virtual extension of their own team.

Google would then have the opportunity to command much higher pricing for those unique versions.

8. Fix Google Cloud business.

Google Cloud is still the new kid on the block, as they were late to the party. They currently sit at about 10% market share.

Still, it generated $26 billion in revenue in 2022 and grew by ~37% from the previous year. The growth figure is an encouraging signal, but it's still bleeding cash.

The choice to place growth above profits may have been a deliberate act, at least according to Google's official narrative. Yet, some believe there might be a murkier root cause of why they struggle to achieve profitability.

If you run a medium margin business like a low margin business, you’ll have a culture that’s oddly frugal.

If you run a medium margin business like a high margin business, you’ll have a business that loses money forever. – Zack Kanter

The view might be radical, but it cannot be denied that getting used to the juicy and “easy” pay-per-click ad margins molds a particular corporate identity and culture that totally contrasts with Amazon's upbringing with razor-thin retail margins.

Despite the underlying causes, if Google is using profits from ads to fund the Cloud business, it may not be a terrible strategy for now. But given the uncertain future of the ads business, they should aggressively set themselves to flip the position at some point:

Turn Google Cloud into a self-sufficient financial powerhouse, ready to step in, at least as a partial substitute, when advertising profits dry up.

9. Step up the hardware game

Google dipped its toes into the hardware arena in 2010 with the release of its Nexus One phone in partnership with HTC. Since then, they've expanded with a range of products, including Pixel phones, smartwatches, earbuds, doorbells, thermostats, home assistants, and security cameras.

Till now, Google keeps its hardware earnings under wraps, bundled within the broad category of "Google Other," which brought in a hefty $29 billion in 2022. Yet, the best opportunity may not be in consumer hardware, as there are way too many competitors driving the margin down.

Google also has a differentiation challenge. Everyone has access to the same Android and Wear OS software. Their move to open-source Android made strategic sense back then to protect the search traffic on mobile. But now, it dilutes the competitive advantage of their phones.

The greener pastures might lie elsewhere for hardware.

It is high time for them to consider venturing into the chip market. They have already introduced their TPUs, designed for optimized machine learning, in 2016, but they have decided to keep them exclusive to their Cloud platform. It is worth reevaluating if that decision is still optimal in the current environment.

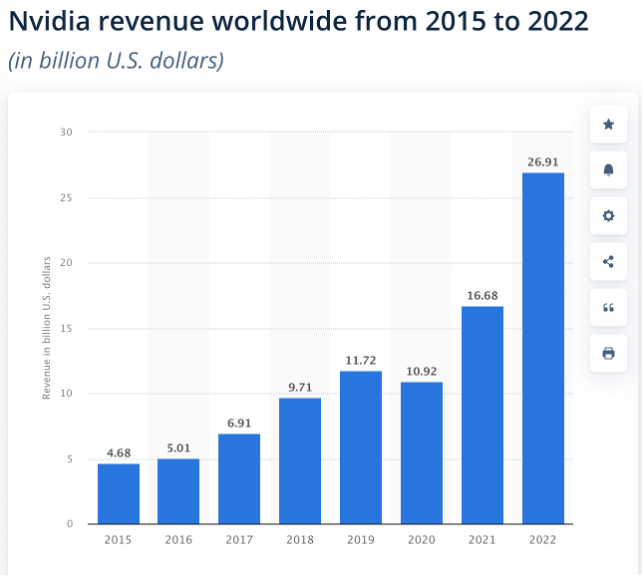

If we look at NVIDIA's revenue evolution, there's a major demand shift occurring in 2021-2022.

Historically, the company business was primarily driven by 3D graphics professionals and gaming enthusiasts. However, the recent exploding demand is driven by AI computing requirements. As a result, NVIDIA has now rebranded as a “World Leader in Artificial Intelligence Computing.”

Their gross margin was 57.8% in the past 12 months, which is not too shabby even by greedy advertising standards.

The obvious move could be for Google to try to buy NVIDIA, but that is very unlikely as NVIDIA has high ambitions of its own. Two years ago, they attempted to acquire ARM from Softbank. The deal didn't go through, though, due to regulatory restrictions.

So, if Google wants to get in the game, it will have to build its own lineup of AI-focused hardware, leveraging the power of its TPUs and potentially new ASICs. This move could ignite a fresh revenue stream that would bring in much higher margins than doorbells.

Final Thoughts

Google is strongly feeling the heat from competition, and trying to keep up with the rapidly evolving tech landscape. Their heavy dependence on search ads puts them in a vulnerable position.

For years, they focused on "moon shots" [3] hoping to land on a game-changing breakthrough, but they've come up empty-handed. So maybe, just maybe, they don't need to reach for the stars after all. The building blocks for a sustainable alternative to the ads business are right in front of them. Their addiction to high-revenue, high-margin ads may have clouded their vision, but the answer may be simpler than they think.

Notes

[1] This does not account for any potential premium that Google may offer as a compensation for the sole purpose of stifling competition.

[2] Not considering any possible contractual obligations for a specified duration.

[3] Self Driving Cars, Project Loon, Google Fiber, Project Ara, Google X, Google Health, Google Glass, Project Wing, … Since the restructuring, some projects have been moved under Alphabet Inc.

Additional Reading

Future of Search: A candid conversation with Sridhar Ramaswmy, an ex-Googler | Om Malik

From Bing to Sydney | Ben Thompson

How much Google should worry about ChatGPT? | Mario Gabriele

The maze is in the mouse | Praveen Seshadri

How to lose a monopoly | Benedict Evans

Resetting the score | Benedict Evans

Zero-Clicks Study | Marcus Tober

Google exec suggests Instagram and TikTok are eating into Google’s core | Sarah Perez